How to get your small business ready to embrace 2019 tax season. Using these goal setting and time management techniques.

Can you believe we are already halfway through 2019? The onset of winter reminds us that tax season is upon us. So now is the time to make sure you are prepared. Did your heart just skip a beat when you read that? Don’t be alarmed, there are many goal setting and time management techniques you can put in place, to minimise the stress around tax time.

Deborah Ricketts, owner of Versatile VA and proudly Streamlined Organising’s very own Virtual Assistant recently gave an inspiring speech in a networking group on time management and goal setting. We asked Deb to share her top four-time management and goal setting tips to assist you with your preparation this tax season.

1) Change unhelpful behaviours

“Time management is about changing your behaviours, not changing time. A good place to start is by eliminating your personal timewasters”. For example, if you find yourself procrastinating when it comes to saving your receipts, expenses and logbooks in an organised format, then you panic at the end of the financial year as you don’t have up to date records for your accountant. Commit to change your behaviour around this, so the next tax season is a breeze.

Block out a few hours in your calendar, on a regular basis, either fortnightly or monthly and honour that time commitment to save your relevant tax receipts, invoices and payments to a well-labelled folder and update your spreadsheet for your accountant or your accounting software with the relevant information. You will reap the benefits of your behaviour shift.

2) Utilise the resources around you to educate yourself

“To avoid the feeling of overwhelm or fear of not knowing what to do, schedule time in your calendar to educate yourself on important tax requirements for your business. It will increase your confidence as a small business owner for the tax season.” Small business tax requirements differ greatly to individual income tax, it also varies considerably depending on your business structure, so it’s important to know your obligations. Deb says “ensure you’re following all the rules by utilising the resources available to you”

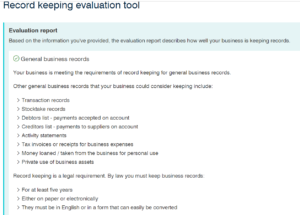

• The ATO website provides a lot of useful tools, start with a record-keeping evaluation tool to assess where you are at, you will receive an evaluation report (example pic). After answering a quick questionnaire listing any areas, where you may need to start keeping better records.

• The ATO website provides a lot of useful tools, start with a record-keeping evaluation tool to assess where you are at, you will receive an evaluation report (example pic). After answering a quick questionnaire listing any areas, where you may need to start keeping better records.

• Another useful resource from the ATO is ‘my deductions’ app. You can use it as an easy repository to take the hassle out of storing and recording receipts and logbook records. They have loads of helpful information on their site including online help and educational workshops

• If you’re still unsure about what tax information is required, consult your accountant. Be conscious not to leave it in June if you want substantial assistance as this is their peak-period.

3) Setting time limits for tasks

“Get in the habit of setting time limits for tasks. Solid blocks of time and ‘deep’ work is most productive. Also, know what time of the day you are most productive and plan around that”. So, you have a long list of ‘to-do’ items in order to be prepared for your tax return submission. One task might be chasing outstanding invoices. So block out 1 hour in your calendar, do not allow yourself to be distracted by anything else and set an alarm to remind you when the hour is up. This approach utilises solid blocks of time and deep work, increasing your productivity. You will be amazed by how much you can accomplish with this approach and you can celebrate mini wins with each task checked off your list. If you know you are the most productive first thing in the morning, then set your highest priority or most challenging tasks for then.

4) Plan for the Coming Year

All right. You’ve done all the tax record keeping and you’re ready to do some business planning. “Set mini goals and start building good habits’, here are some suggestions:

- Set next year’s goals with clear time frames and a breakdown of achievable tasks. Focus on one goal at a time and remember to celebrate the mini wins once you achieve your target.

- Outline a system you can use to make the tax preparation process smoother next year.

- Plan for major expenses

Large purchases with ongoing commitments can be easily planned for. Maybe you want to hire a business coach, or invest in cloud accounting software, whatever it is, plan the payments in advance. Set up a separate business savings account and transfer money regularly so that when the payments are due you have the money available. The same concept applies for tax debts. If you are not submitting BAS statements, set aside money for a potential tax bill. It can be hard to foresee every expense coming your way, but if you can plan and prepare for major costs, you’ll be in a much better place long term. Build in a contingency plan, where you forecast for large expenses, such as maintenance, supplies & staff costs on a regular basis.

If you are still panicking that you won’t be ready this tax time, feel free to contact Streamlined Organising, and one of our talented Virtual Assistants would love to help you out with all your office administration and organising streamlined processes. Find out all the ways a VA can help with tax season here.

Remember when you get organised this year, you’re paying it forward to yourself for next year. Don’t forget to reflect upon an amazing year in business, looking at what worked, what needed improvement and new targets for next year.

Celebrate your achievements, this is a perfect time of the year to reward yourself for a job well done!

Recent Comments